Keo Lukefahr is the head of derivatives and renewables trading for Motiva Enterprises. She has worked in the energy industry for more than two decades serving in senior trading and strategy roles for several leading energy companies. Prior to joining Motiva, Lukefahr served as head of Americas Natural Gas and LNG Trading for PetroChina International, and vice president for Eastern US Natural Gas trading for BP. Earlier in her career, she was a principal at the strategy-consulting firm Booz Allen Hamilton where she specialized in the energy sector. Lukefahr began her career as a crude and products trader for Cargill. She holds a Master of Science in Applied Economics from the University of Minnesota and a Bachelor of Science in Economics from the University of Washington. Prior to attending graduate school, Lukefahr worked for the U.S. Peace Corps in Africa.

Lukefahr talks to Rebecca Ponton about the state of energy trading and what it’s like to navigate the world of trading as we enter the post-COVID era.

Rebecca Ponton: What does your job entail? What are your responsibilities as head of derivatives trading?

Keo Lukefahr: As head of derivatives and renewables trading for Motiva, my group is responsible for providing central futures execution services for our physical teams, managing our system price exposure, and developing and implementing anticipatory and corporate hedging strategies. In addition to managing and executing all of the company’s derivatives trading, we also provide a strategic point of view of the market for the company, including supply/demand balances and price outlooks. We are also currently developing Motiva’s renewables trading program and strategy.

RP: How has the ongoing COVID-19 pandemic affected your work and that of the traders under your leadership?

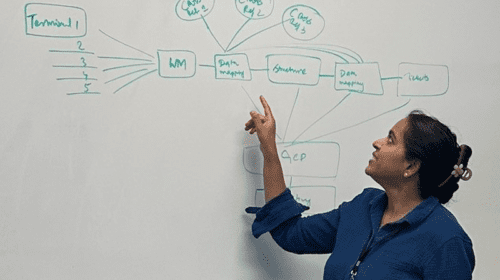

KL: Our derivatives desk spent nearly six weeks working from home at the start of the pandemic. During this time, we were able to leverage existing technology to create a virtual trade floor and effectively manage our risk. While there are always advantages to being physically co-located, we were able to use voice and video conferencing, as well as existing collaboration tools, to establish a highly effective virtual trade floor at nearly zero incremental cost to the company. Once the State of Texas and the CDC began allowing people to return to the office, we brought the team back together in a staged return to work plan. We have all been fully in the office since the middle of last summer.

RP: In less than 24 months, we have seen the market whipsaw from negative oil prices in April 2020 to over

$130/barrel with Russia’s invasion of Ukraine. How is the market responding to this extreme volatility?

KL: The market is seeing a very significant reduction in liquidity. During the dramatic price drops in COVID-19, we saw a number of players, particularly physical players, reducing their participation and exposure. Over the last year, open interest has steadily declined and more recently, a number of participants got severely impacted by margin calls and have now retreated to the sidelines. The effect of this much lower liquidity is to further exaggerate price swings on a day-to-day basis. Events and information that would typically spur a one to two percent daily price move now often precipitate a four to six percent move. In the first quarter of 2022, to have seen even greater swings in crude prices, but the bigger story has been the profound daily and weekly movements during this period. I do not expect short-term volatility to dampen until liquidity returns to the market and longer term volatility is anyone’s guess right now given world events.

KL: From the outside, the energy markets can appear a bit chaotic right now, but if the past few years have demonstrated anything, it is the incredible resilience, efficiency and effectiveness of the energy trading markets. The energy system encountered multiple simultaneous shocks that were each, in their own right, unprecedented in scope and scale. During COVID-19, we saw a significant impact on supply and logistics, the unprecedented transportation fuels demand drop, and a simultaneous collapse of the OPEC price support program that has been a foundation for crude production and supply for more than 40 years. As the world began to emerge from COVID-19, we saw a sudden resurgence in demand that exacerbated the logistics problems, huge inflationary pressures across the world, the Russian invasion and the broad sanctions that followed, and a resurgent pandemic, especially in China.

Despite these simultaneous shocks to the system, crude, products and other forms of energy continue to be widely available, contracts are honored, and there has been no significant disruption. In short, there was no panic, just rapid reaction (and in some cases overreaction) to the rapidly shifting market situation. Moreover, thanks to the highly efficient derivatives market, most producers and many refiners have continued to be able to shield their business operations from the worst of the price volatility through hedging. As a result, we saw far less abrupt financial distress in energy during COVID-19 than we have seen in many other industries – from airlines to restaurants to retail – and we are seeing an effective response to the rapidly changing price signals.

RP: With everything that has gone on during the past three years – the ongoing global pandemic, the drop in the price of oil and the stock market crash in 2020, both of which have rebounded, a change of presidential administrations – what does the future of trading look like?

KL: People often think of energy trading markets as somehow similar to the stock market or the currency market. They are not. Those markets are merely price discounting mechanisms that reflect the current consensus value of an asset with an infinite (or at least indeterminate) lifespan. The energy markets deal in assets that are produced and consumed on a short time scale. Their purpose is to ensure the right energy product gets to the right place at the right time in the most efficient manner possible while allocating price risks to the entities that are best able to bear them.

Throughout the unprecedented market shocks of the past few years, the energy trading markets have performed brilliantly. Product from tens of thousands of production sites were efficiently routed through the more than half a million miles of logistics assets and thousands of vessels to the right storage and refining assets. The market provided accurate and timely signals to ensure the hundreds of refineries around the world adjusted product mix and output levels in real time to get the correct final products into the hands of billions of consumers in real-time with maximum efficiency and almost no disruption. That is an incredible accomplishment and it underscores the efficiency and effectiveness of the global energy trading system. Not only that, it managed to accomplish this feat while the vast majority of market participants were working remotely from home!

The market learned important lessons from the price volatility and made changes to manage that sort of event in the future. We are seeing zero-dollar floors in physical crude contracts, for example, to prevent a repeat of the April 2020 negative pricing anomaly. The longer-dated futures contracts will better price in these sort of black swan events. We are now seeing the markets begin to rethink energy flows in light of the current geo-political situation. We are expecting to see meaningful demand response as a result of the recent price rise and we should see some supply response, but it will be more muted than in the past.

Over the next few years, the markets will be working out how to incorporate government policies related to carbon. These remain highly uncertain at the moment, but I expect that we will see some form of carbon intensity grades on crude oil. This will add a new dimension to the price equation, but it is an exceptionally efficient way to reduce near-term CO2 by valuing less carbon intensive feedstocks more highly than the high carbon intensity alternatives. The trading markets are the most logical and effective way to referee these trade-offs once the policies are set.

Stepping back from market dynamics, the long-term trends toward more electronic trading will continue, as will the continual refinement of algorithmic assistants and increasing transparency in information enabled by technology. I expect we will continue to see innovation on traded products and especially on carbon-related products, increasing innovation in derivative instruments that are better designed for specific needs, and continued expansion of the markets to provide liquidity and efficiency in emerging markets.

As the world begins to seriously pursue the multi-decade transition away from fossil fuels, the energy trading markets will play a critical role to ensure that the energy needs are met in the most efficient way possible. I continue to believe that when someone writes a business history on this period that began with COVID-19, and is continuing through the economic and geopolitical disruptions we continue to experience, I think they will conclude that the world’s largest, most complex marketplace – the global energy market – endured simultaneous and unprecedented economic shocks and continued to operate effectively, efficiently, and to ensure suppliers and customers contracts were fulfilled as promised. It can, and it should, do the same as the world manages its way through the complex transition to new, lower carbon energy during the coming decades. That is a great story.

About Motiva: Headquartered in Houston, Texas, Motiva refines, distributes and markets petroleum products throughout the Americas. The company’s Port Arthur Manufacturing Complex is comprised of North America’s largest refinery with a crude capacity of 630,000 barrels a day, the country’s largest base oil plant, and an adjacent chemical plant. Under exclusive, long-term brand licenses with Shell and Phillips 66 (for the 76® brand), Motiva’s marketing operations support more than 5,000 retail gasoline stations. The company’s 2,400 U.S. employees are dedicated to delivering excellence and having fun making a difference. Motiva is wholly owned by Aramco.

Headline photo courtesy of Ana Lavalle.

Rebecca Ponton has been a journalist for 25+ years and is also a petroleum landman. Her book, Breaking the GAS Ceiling: Women in the Offshore Oil and Gas Industry (Modern History Press), was released in May 2019. For more info, go to www.breakingthegasceiling.com.

Oil and gas operations are commonly found in remote locations far from company headquarters. Now, it's possible to monitor pump operations, collate and analyze seismic data, and track employees around the world from almost anywhere. Whether employees are in the office or in the field, the internet and related applications enable a greater multidirectional flow of information – and control – than ever before.