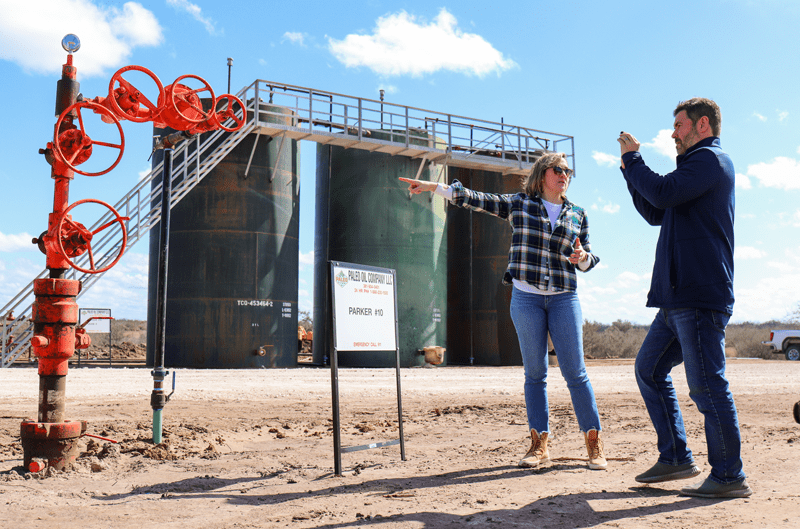

How does a geologist from Boulder, Colorado, find herself running an off-grid Bitcoin mine on the outskirts of Beeville, Texas?

Like all great journeys, it started with a giant leap of faith. In 2021, I was approached with an offer from the owners of EnergyFunders, a digital platform that connects individual investors with direct oil and gas investments at the wellhead. They were rebranding the business and overhauling their existing team, and wanted me to lead the effort as CEO.

It was a huge risk. After all, I was comfortable running the private oil and gas exploration company that I founded, Century Natural Resources. But sometimes, comfortable can mean stagnant. And after all, there are thousands of oil and gas companies. There was only one company promising to revolutionize the very concept of energy investing.

EnergyFunders presented an opportunity to disrupt business as usual, by opening up the opaque world of direct oil and gas investing to the individual. The business model was similar to online real estate platforms, like FundRise or Cadre, that opened up access to previously exclusive investments in commercial real estate development. The EnergyFunders digital platform brings this model to the even more complex – and potentially more lucrative – world of oil and gas investing.

After long consideration, I decided that this was a mission on which it was worth risking it all.

The key swing factor in the decision was the alignment in philosophy I shared with the owners of the organization. You see, traditional oil and gas companies are risk-averse, conservative organizations. The reason I started my own oil and gas company was to break free from this mold. Even though the principals of EnergyFunders have decades of experience as successful oilmen, they’re not afraid to challenge the status quo and re-think every aspect of the business – and that’s how we got involved with Bitcoin mining.

I first came across Bitcoin mining at my previous company, Century Natural Resources. One of our wells was producing excess natural gas as a by-product from oil production, and local regulations prevented us from flaring that excess gas. So, we needed a way to divert that gas in order to keep the well running.

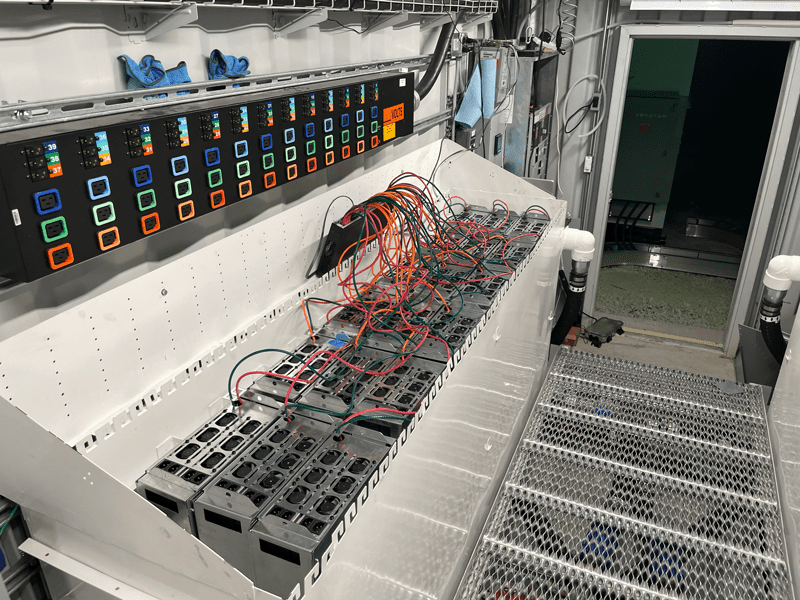

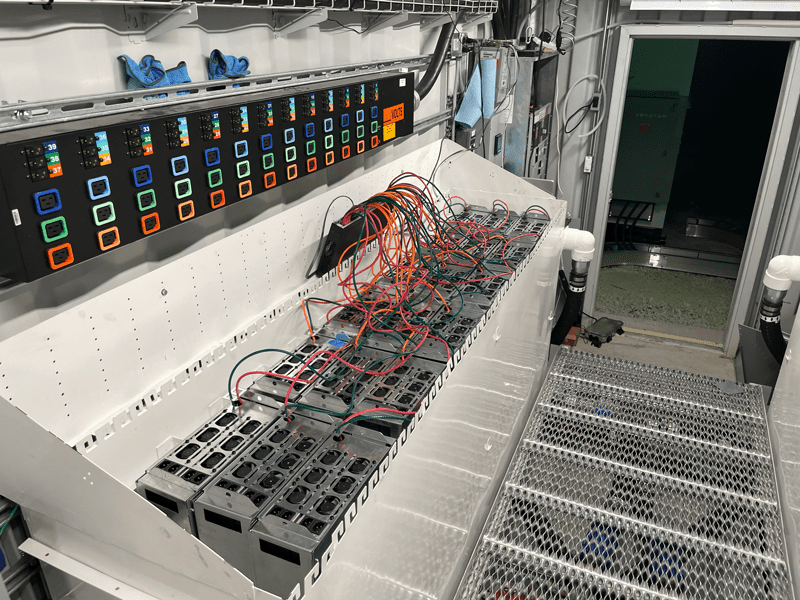

After consulting with our private equity sponsor, we learned that our sister company faced a similar problem with one of its wells in the northern DJ Basin in Colorado. Its solution was to divert the excess gas to an onsite natural gas generator, which supplied power to a series of ASIC computers specially designed for Bitcoin mining.

It was an elegant, win-win solution that turned the liability of excess gas into an asset, in the form of newly minted Bitcoins.

Back then, I admittedly didn’t know the first thing about cryptocurrencies or Bitcoin mining. But I received a trial-by-fire education, when we were lucky enough to borrow their Bitcoin mining set up and install it on our well site.

After seeing the rig in operation and, more importantly, the compelling unit economics, the lightbulb went off. I realized that this same idea could work for thousands of other wells throughout the country. And not just for the currently-producing wells with excess gas, but also for countless other low-cost gas reserves that were “stranded” by lack of pipeline takeaway connections. Bitcoin mining could allow this previously untapped source of low-cost gas to be monetized in a way that was previously impossible.

From that point on, I went down the crypto rabbit hole and emerged as a full-on Bitcoin maxi. I even started purchasing Bitcoin for my own personal portfolio. When I left Century Natural Resources to assume the role of CEO at EnergyFunders, I mentioned the idea to our principals. As long-time oil and gas operators, they had access to numerous natural gas wells located in remote areas that were going untapped due to lack of takeaway infrastructure.

They were admittedly skeptical at first glance but, after crunching the numbers, they quickly realized the scope of the opportunity. Most importantly, the concept was a perfect fit within the broader mission of EnergyFunders to democratize access to the previously exclusive world of direct energy investing. Even though Bitcoin mining has enjoyed explosive growth over the past several years, it’s still out of reach for many small investors, who lack the capital required or expertise to build a Bitcoin mine.

We also learned that many of our existing energy investors were thrilled to get access to this unique way of Bitcoin investing. We started on the journey to make Bitcoin mining accessible to individual investors, by offering access to a fractional ownership in off-grid Bitcoin mining, powered onsite directly from wellhead natural gas.

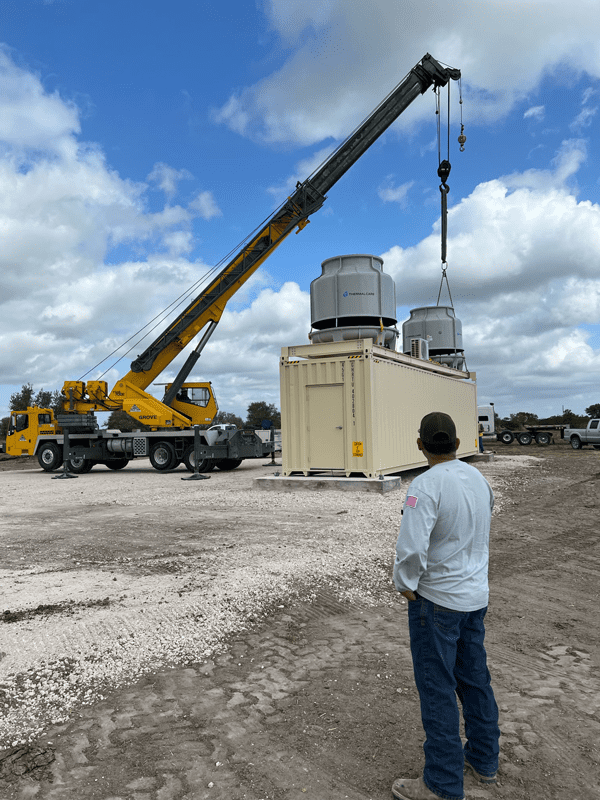

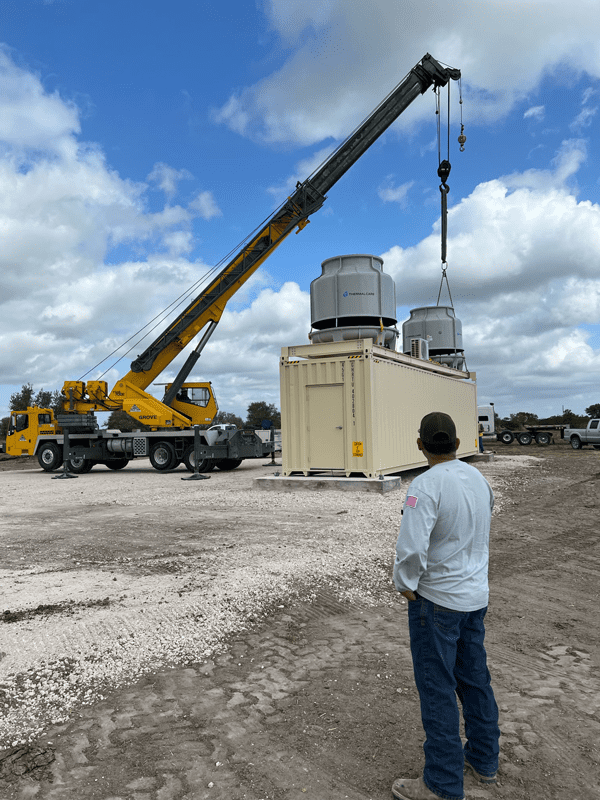

We’re now over a year into this project, and we’ve had our share of ups and downs in proving the concept. Despite my previous experience and the deep technical background of our engineering team, we faced many new technical challenges in building a new onsite mining model from the ground up.

In working through these challenges, we’ve developed a robust first iteration that we believe is truly scalable to the oil and gas world at large. The biggest challenge, like in oil and gas investing, is managing the commodity price cycle. Even though we greenlighted the project when Bitcoin was trading at around $45,000, by the time we had mapped out the blueprint, finalized offering documents and raised capital, Bitcoin prices had climbed to $65,000. Along with higher Bitcoin mining prices, the cost of the mining computers rose as well.

Of course, we all know what has happened with prices since. This decline in prices has presented an economic headwind to the first iteration of our mining efforts, given the differential between input costs and current Bitcoin pricing.

The biggest thing that I’ve taken away from the entire process is that oil and gas economics are very similar to Bitcoin economics. They’re both highly cyclical commodities, which means that successful investing requires a contrarian mindset. Many of the investors who were excited to put capital to work at the peak in prices are now more cautious, given the recent price declines. As a natural contrarian, I’ve personally never been more excited about the prospects of Bitcoin mining than I am today.

As Bitcoin prices have fallen over the past year, so too have the costs of mining; most notably, we’ve seen a large drop in the key input of computing prices. If you’re a believer in the long term viability of Bitcoin, there’s truly never been a better time to get involved in this space. Over the last several years, miners like EnergyFunders have proved their processes and worked out the technical challenges. Now, with a robust mining process ironed out, we look forward to capitalizing on today’s compelling economics to scale up this model in the years ahead.

Life is all about risks, and oftentimes those who make the leap early fight the toughest battles to see the greatest rewards. We’re excited to be at the forefront of these complex challenges, and look forward to rewarding our investors who believe in the future of Bitcoin.

Q & A With Laura Pommer

Rebecca Ponton: You started your career in the oil and gas industry as a geologist. What was the motivation for you to leave a stable career path and go out on your own?

Laura Pommer: I have always been highly risk tolerant. Any good exploration geologist needs to be. I think because of that I have a more natural tendency to be entrepreneurial. When I fell out of the nest of a comfortable, stable job, and into the world of entrepreneurship, it really didn’t faze me very much. I’ve always wanted to control my own destiny and blaze my own path, even if it means less stability along the way.

RP: You founded Century Natural Resources and were CEO at a relatively young age. Where did you find the courage to take that risk?

LP: To be brutally honest, I didn’t truly understand what a big deal it was at the time. I think that made it easier for me to take the leap. I also had a very supportive network that encouraged me along the way. A few months into the job, I had a realization about what a monumental undertaking it was, and decided to dedicate as much time as possible toward making the company a success, sometimes to the detriment of my personal life. I took it upon myself to be an example for young female oil and gas or technical entrepreneurs behind me. I really want to help pave the way for smart young women to do what I’ve been lucky enough to do.

RP: You are now CEO of a second company, EnergyFunders. What advice do you have for other women who aspire to become entrepreneurs?

LP: My advice is to not let the job entirely take over your life. It can be very easy to do and, in the first role I had as a CEO, I definitely succumbed to it. Now I have a much more reasonable work/life balance. A lot of roles do not afford that and so it is a higher risk. I have made enormous personal sacrifices in order to get to where I am. Perhaps the most difficult truth to swallow is that I didn’t always consciously choose to make some of those sacrifices. Sometimes they just happened. You need to be extraordinarily flexible to be in this line of work and extremely open to learning and change.

RP: How do you reassure investors over concerns about Bitcoin mining in light of the “crypto winter” in 2022 and the collapse of FTX?

LP: The most important thing to appreciate is that Bitcoin is not synonymous with cryptocurrency. In my opinion, the only important cryptocurrency as a store of value is Bitcoin. Ethereum can be used for development protocols, but Bitcoin is the only reasonable answer to the inflation and corruption issues that we have with fiat currency. The FTX collapse was a Ponzi scheme that, unfortunately, duped a lot of very wealthy individuals. I think the most important takeaway here is to never blindly follow people without doing due diligence. There are many other companies doing what EnergyFunders does, and I always recommend that our investors closely examine the background of the people who are running their money. There’s a lot of cloak and dagger stuff out there, and full transparency, including audited financial statements, is one of the most important things that you should demand as an investor.

RP: Any predictions regarding the future of bitcoin mining as it pertains to the oil and gas industry?

LP: I know for a fact that more large oil and gas companies will begin mining Bitcoin in the years to come. For many, it will turn into more of a hedge rather than a primary monetization stream. Given the “crypto winter” that we are experiencing right now, the progress may be slowed in the near term. But the true contrarian capital allocators out there who believe in the technology and in Bitcoin – either as a hedge or as a monetary asset to accumulate – will be the ones best positioned to thrive on the other side, in what we believe is still a long-term bull market in Bitcoin.

EnergyFunders CEO Laura Pommer previously served as the CEO and lead geologist of Century Natural Resources. Pommer, along with her partners, founded Century in October 2018 with $75 million in private equity sponsorship. In her role as CEO, she guided the company’s development and management of approximately 150,000 acres in the Powder River basin. This included organic development of both conventional and unconventional assets, ranging from PDP to exploration plays.

Before leading Century Natural Resources, Pommer worked in exploration and operations for Anadarko petroleum’s U.S. onshore assets. She also worked for various private equity backed companies on regional and asset level mapping, log interpretation, risk analysis and deal evaluation. A geologist by training, Pommer earned her master’s in geology from the University of Texas at Austin and her bachelor’s in geology from the University of Colorado.

Pommer’s experience in deal evaluation and risk analysis, from both a geological and financial perspective, makes her the perfect candidate for achieving EnergyFunders’ key objective: Elevating the quality and reducing the risk of investments offered on the platform. She is helping lead the emerging movement toward ESG-principled investing. As a female leader in a male dominated industry, Pommer is passionate about mentoring and recruiting more young women into the industry.

Oil and gas operations are commonly found in remote locations far from company headquarters. Now, it's possible to monitor pump operations, collate and analyze seismic data, and track employees around the world from almost anywhere. Whether employees are in the office or in the field, the internet and related applications enable a greater multidirectional flow of information – and control – than ever before.