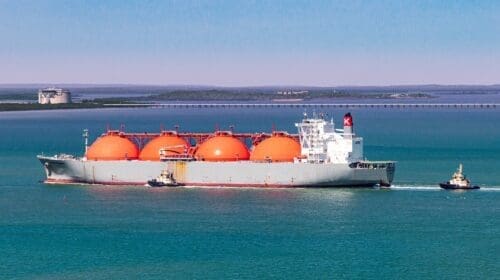

Today’s oil and natural gas markets must deal with a number of wild cards (climate change mandates, rising inflation, possible recession) but the revival of China’s economy and Russia’s oil and gas production and exports are keeping energy forecasters up late at night.

The International Energy Agency (IEA), which represents 31 different countries that are primarily net importers of oil and gas (the U.S. is the only member that is a net exporter), issued its monthly reports this week and China’s petroleum demand and Russia’s exports were center stage.

World oil demand will climb by 2 million barrels per day (b/d) in 2023 to a record 101.9 million b/d because China’s resurgent economy, which is coming out of Covid lockdown, will account for 90 percent of growth, IEA stated.

Russia, one of the largest oil exporters historically, must deal with sanctions placed on its oil and gas sales to other countries.

However, IEA reported Russia’s oil exports in March soared to the highest since April 2020 thanks to surging product flows that returned to levels last seen before Russia invaded Ukraine. Total oil shipments rose by 0.6 million b/d to 8.1 million b/d, with products climbing 450,000 b/d month-over-month to 3.1 million b/d. Estimated oil export revenues rebounded by $1 billion to $12.7 billion but were 43 percent lower than a year ago, according to IEA.

Additionally, extra cuts by OPEC+ will push the world oil supply down 400,000 b/d by the end of 2023, according to IEA’s study. From March-December, gains of 1 million b/d from non-OPEC+ failed to offset a 1.4 million b/d decline from the producer bloc. For the year as a whole, global oil production growth slowed to 1.2 million b/d versus 4.6 million b/d in 2022. Non-OPEC+, led by the US and Brazil, drives the 2023 expansion, rising 1.9 million b/d. OPEC+ is expected to drop by 760,000 b/d.

OPEC+ supply cuts immediately triggered a $7 per barrel jump in North Sea Dated crude to $85, up nearly $15 from March lows.

West Texas Intermediate traded on the New York Mercantile Exchange has averaged around $80 per barrel during April.

Natural gas, on the other hand, has been hit with an oversupply situation and it has been trading at just over $2 per million British thermal unit, which is down from the $9 range a year ago.

Alex Mills is the former President of the Texas Alliance of Energy Producers.

Alex Mills is the former President of the Texas Alliance of Energy Producers. The Alliance is the largest state oil and gas associations in the nation with more than 3,000 members in 305 cities and 28 states.

Oil and gas operations are commonly found in remote locations far from company headquarters. Now, it's possible to monitor pump operations, collate and analyze seismic data, and track employees around the world from almost anywhere. Whether employees are in the office or in the field, the internet and related applications enable a greater multidirectional flow of information – and control – than ever before.