Africa finds itself at the crossroad of reducing energy poverty (less than half of its population has access to electricity), adopting an energy transition that is designed by and for western countries to address climate change, and being the alternative source of energy for the West to fill the gap created by Russia. It is not an easy equation to solve for oil and gas-producing African countries. With the current mounting pressure to ramp up production, the lack of exploration investment in the last few years, and the decline of production in mature fields, the ability to totally fill in the gap left by Russia in the market is a challenge.

So, what is the status of the African energy market, and what is Africa’s best interest in this dilemma?

The African energy market is very diverse and can be divided into several key areas:

West Africa

This is a mature crude oil-producing region. Two of the 10 leading crude oil producers in the continent, Nigeria and Angola, are in this area. Together, they produced ~2.2 million BPD, with the Republic of Congo, Gabon, Ghana, Equatorial Guinea and Chad accounting for a total production of ~790 thousand BPD. Oil and gas investments (especially in exploration) in the region were at their lowest in the last few years because of the COVID-19 pandemic and the shift to renewable energy for most of the multinational companies (i.e., Shell, BP, Exxon Mobil, etc.) that were the main players in the region.

With African governments opening development opportunities, recent oil and gas discoveries, and frontier prospects in the area (Senegal, Côte d’Ivoire, Angola, etc.), the increasing implication of national oil companies, and the market entry of indigenous and independent, international companies, and the focus on energy security have created the urge for investments in exploration and production.

West Africa’s offshore exploration and production activities are expected to dominate the market soon. 2023 is expected to be the Year of Gas for West Africa with several massive upstream gas and liquefied natural gas (LNG) projects coming online as part of efforts to maximize resource exploitation, accelerate electrification progress, and ensure energy security on a global scale. (i.e., Senegal and Mauritania’s Greater Tortue Ahmeyim (GTA) Floating LNG (FLNG) development first phase; Côte d’Ivoire Baleine Phase 1 project, etc.).

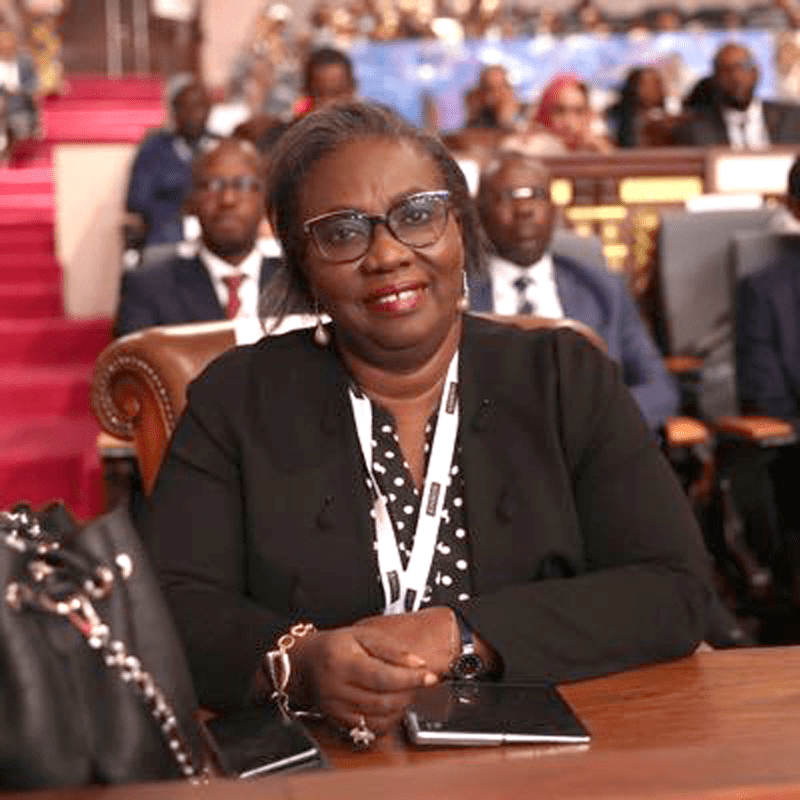

Senegal is alone in the region with the only female minister of petroleum and energies, Sophie Gladima, the former minister of mines and geology, who was appointed to her current role in 2020. A professor at the Cheikh Anta Diop University in Dakar, Gladima holds a doctorate in hydrogeology, applied geophysics and hydrochemistry. Following COP26 in 2021, she was quoted as saying the conference had been a “death blow” for Africa, but added, “I am pleased to announce that it has not stopped us from progressing. We must celebrate … and we must follow our own African narrative at COP27,” which was held in Egypt in November 2022.

North Africa

North Africa is the leading African oil and gas-producing region. Algeria is Africa’s leading exporter of natural gas and the seventh largest in the world. Algeria, Egypt and Libya are the leading producers in the area. Algeria and Egypt drive the gas production in Africa. Algeria accounts for 35 percent of the continent’s gas production, and Egypt contributes 25 percent. Consumption is also concentrated in those two countries, making up 66 percent of African consumption.

As markets tighten due to lost supplies from Russia, North African producers with a long track record of providing stable energy supplies to European countries are expected to play a vital role in averting global shortages. Several countries seeking to reduce their dependence on Russian supplies since the invasion of Ukraine have turned to Algeria. In April, Italy signed a major agreement with Algeria on increased gas supplies. Algeria has since been intensively drilling to increase its production of oil and gas. Its renewed attractiveness as an investment destination amid Russia’s isolation is expected to boost the development of new oil infrastructure.

Egypt plays a vital role in international energy markets through the operations of the two Suez Canal transit points and the Suez-Mediterranean (SUMED) pipeline. Egypt is working to boost its operations after the discovery of the Mediterranean’s largest deposits of LNG and potentially supply more gas to the European market. Egypt’s exports of LNG are expected to peak in 2023 and investments to grow considerably, in order to explore and develop new sources of gas.

Libya has vast reservoirs of oil and gas that may be used to boost growth in the sector. However, it is expected that production may remain volatile due to political instability, a lack of funds, and aging infrastructures.

East Africa

The offshore segment in East Africa is expected to witness significant growth due to heavy investment in offshore oil and gas projects, especially in Mozambique and Tanzania.

Over 100 trillion cubic feet of natural gas reserves have made Mozambique one of the most attractive gas plays worldwide. The country celebrated the export of its first-ever liquefied natural gas (LNG) shipment to Europe in November 2022. The first LNG shipment comes at a time Europe urgently needs a replacement for Russian gas. The start of production of Mozambique Rovuma gas comes at an important moment, as LNG plays a key role in supporting energy security.

Tanzania’s Liquefied Natural Gas Project (TLNGP) has the potential to change the history of Tanzania. Tanzania has signed a framework agreement with Norway’s Equinor and Britain’s Shell that will bring them closer to starting construction on a $30 billion project to export liquefied natural gas (LNG). TLNGP foresees a final investment decision by 2025, and a start of operations by 2029 – 2030. It marks a significant step forward in Tanzania’s efforts to jumpstart the export of part of the vast gas deposits off its coast, estimated at more than 57 trillion cubic feet.

The East Africa Crude Oil Pipeline project (EACOP) is one of the projects Uganda has planned to monetize its oil and gas assets, which are currently valued at ~US$ 116 billion (gross). The East African Crude Oil Pipeline Project (EACOP) is a pipeline that will transport oil produced from Uganda’s Lake Albert oilfields to the port of Tanga in Tanzania where the oil will then be sold onwards to global markets.

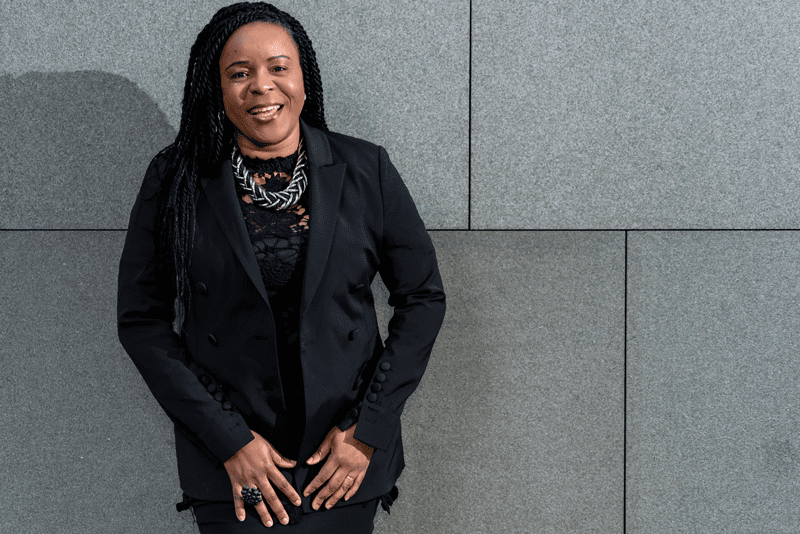

Uganda has seen three female ministers of energy and mineral development in succession. From 2011 – 2018, electrical engineer Irene Muloni held the position, overseeing much of the Lake Albert development, until 2019 when Dr. Mary Kitutu, an academic and environmentalist, assumed the role. In 2021, Ruth Nankabirwa, a career politician, was appointed to the cabinet position, which includes the exploration and development of the country’s petroleum resources, along with oversight of the power supply.

Nankabirwa has expressed hope that Uganda will see first oil by mid-2025, and has also been quoted as saying, “As a country, we are earnestly pursuing energy integration before we can talk about energy transition.”

South Sudan’s oil and gas industry is untapped and has growth potential. It is the major oil producer in the East African region. South Sudan’s oil and related sectors are attracting enthusiasts. Africa-focused British independent energy company, Savannah Energy, has announced the acquisition of producing oil fields from Malaysian state oil and gas company, Petronas for $1.25 billion.

Southern Africa

Southern Africa is becoming an attractive destination for upstream investment thanks to giant offshore finds. The 2019 condensate discovery off the southern coast of South Africa, and two new Namibia finds in early 2022 by Shell and Total Energies are expected to attract major oil companies and drive significant new upstream oil activity offshore. The discovery comes at a crucial moment for global energy markets as oil and gas prices rocketed after the Ukraine war started. There is also onshore potential for both coal bed methane and shale gas, with significant recoverable shale gas resources in the semi-desert Karoo Basin.

South Africa faces several challenges such as a lack of supply and insufficient gas infrastructure. Exploration and appraisal will be key to unlocking new oil and gas opportunities.

The African oil and gas industry is entering a new era. Countries including Egypt, Algeria, Nigeria, Senegal, Mozambique, Congo-Brazzaville and Equatorial Guinea have sizable gas reserves, and they must use their gas resources. As far as the energy transition is concerned, they can use gas as a transitional energy. Africans should remain committed to their goals to curb climate change; however, their ambitions should not stand in the way of their developmental imperatives, among them, ending poverty in Africa.

Cameroon attorney, author (Billions at Play), and executive chairman of the African Energy Chamber, NJ Ayuk has been an outspoken proponent for the inclusion of women in all sectors, including Africa’s energy industry. In a December 2022 LinkedIn post, Ayuk wrote, “By empowering women, we empower all Africans.”

Headline Photo: Nigeria, long the top oil producer on the African continent, was surpassed by Angola in 2022. (Green and white colors of the Nigerian flag.)

Oil and gas operations are commonly found in remote locations far from company headquarters. Now, it's possible to monitor pump operations, collate and analyze seismic data, and track employees around the world from almost anywhere. Whether employees are in the office or in the field, the internet and related applications enable a greater multidirectional flow of information – and control – than ever before.